Exponent II, Inc is classified by the IRS as a public charity and a qualified 501(c)(3) organization. In 2022 we engaged a legal firm with expertise in non-profit organizations to help ensure that we were meeting all of our legal requirements and were current in all our obligations. We have filed taxes each year, including the current one, and all required information is also current with the Massachusetts Attorney General’s office and Massachusetts Secretary of State’s office where we are incorporated.

Our annual 990-EZ federal forms through 2022 are able to be viewed here.

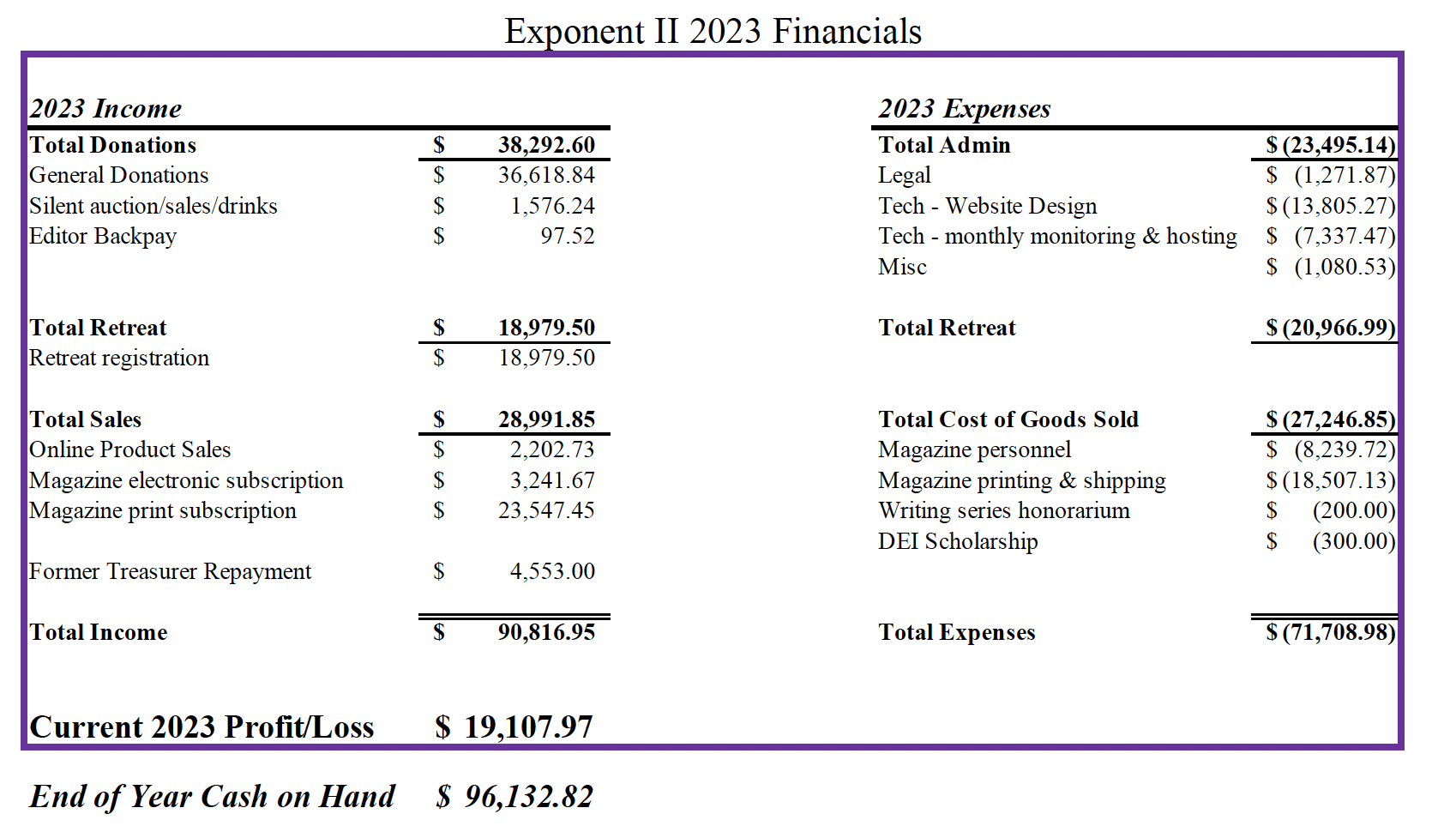

We at Exponent II are grateful for all financial support given us, whether in the form of a subscription to the magazine, payment of retreat registration, or in a donation and we strive to be good stewards of those funds. Our board members serve without financial compensation and the majority of those who provide the work that supports the activities of Exponent II are volunteers. In an effort to support valuing the work of women, Exponent II began offering small stipends to magazine staff and contributors in 2022. In addition, when Exponent II contracts with outside entities, we actively search for women-owned businesses and request female project managers.

All financial statements are reviewed monthly by board members and are audited regularly by an individual not currently in organizational leadership.

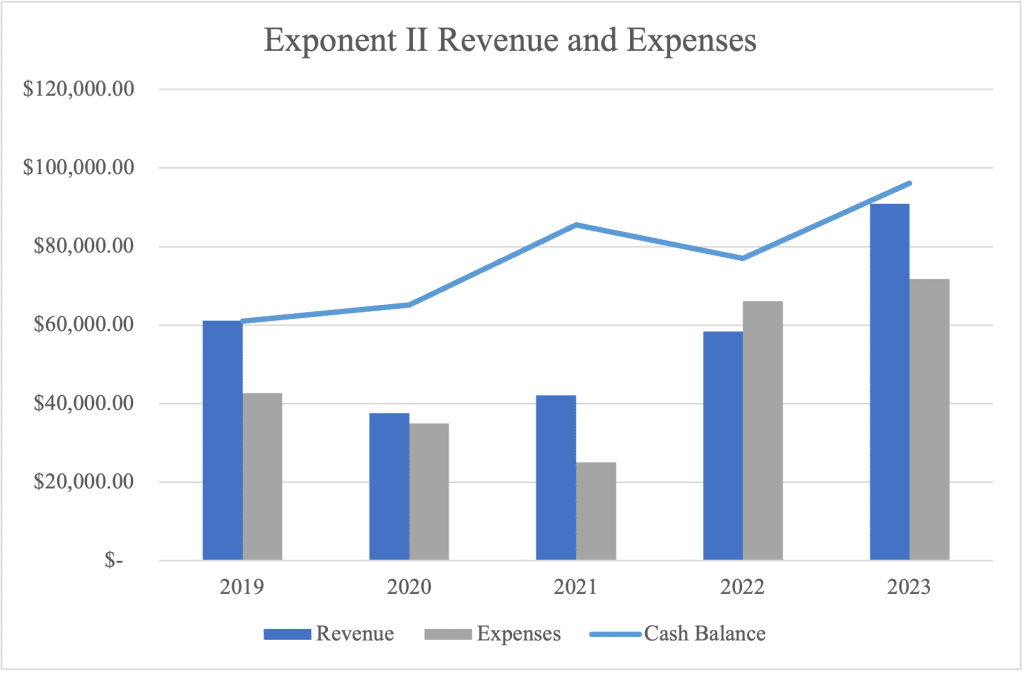

Below is a summary of our income and expenses for 2023. We will continue to publish annual financial reports as they become available.